Blockchain: Which Custody for Which Tokens?

The organization of custody for crypto-currencies or other crypto-assets (also called tokens) must consider certain peculiarities, for example the absence of an issuer identified for crypto-assets or the lack of control of the custody process.

In France, since the dematerialisation of securities in 1984, the ownership of financial securities is recorded by an entry in a securities account, an account that can be held:

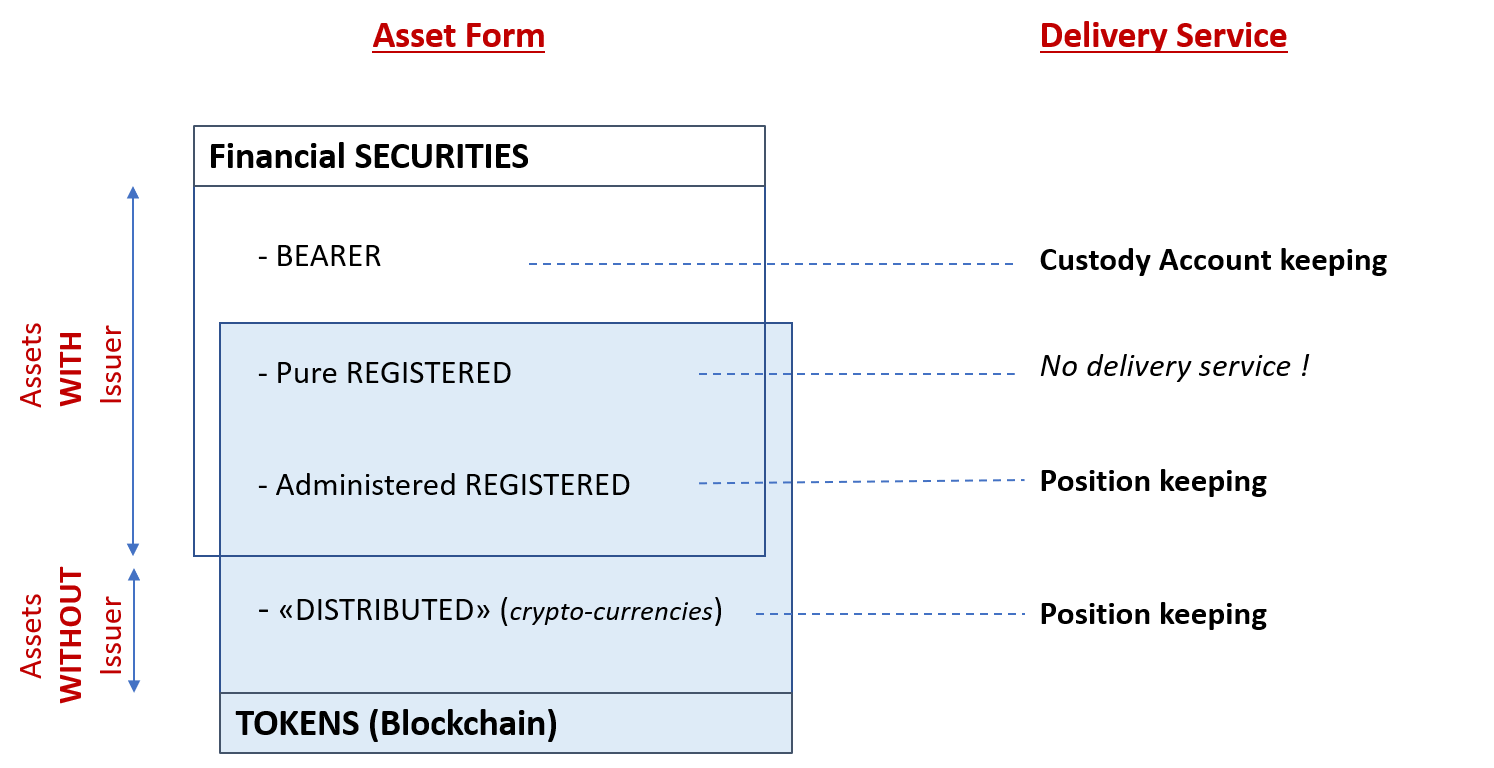

either by a financial intermediary who is an approved Custody Account Keeper, in which case they are called Bearer securities because the identity of the holders is not communicated to the issuer when these securities are exchanged;

or by the issuer of the securities themselves, in which case they are called Registered securities because the issuer knows the investor’s identity. If the investor mandates an intermediary to hold the securities account opened with the issuer, we talk about "Administered Registered Securities", whilst in the absence of intermediation we talk about "Pure Registered Securities".

Whilst the relationship with the issuer is intrinsically facilitated for registered securities, ownership transfer procedures are reputed to be simpler and faster for bearer securities. In all cases, it is the holder of the official securities account (issuer or intermediary) who is legally responsible vis-à-vis the end investor and guarantees the latter’s ability to exercise the rights associated with the securities’ ownership throughout this security’s life cycle. The fact that the investor can freely change account holder means that the latter must be in a position to return the securities to their holder at any time. Of course, no such guarantee can be provided by the custody account keeper unless they have the technical tools to ensure this custody.

The case of crypto-currencies

As these crypto-currencies do not have an issuer, the responsibility for keeping the issuer register is no longer centralized over a single entity but "distributed" in the community of cryptocurrency holders.

The recent French PACTE law passed on 11 April 2019 more or less called this premise into question by attempting to define an “actif numérique” (another name for token) custody service where the service provider is generally not able to control the system that ensures the transfer of these assets’ ownership. Indeed, this system is based on the Blockchain that was originally designed specifically to ensure the transfer of ownership and custody of cryptocurrencies such as Bitcoin or Ether. As these crypto-currencies do not strictly speaking have an issuer, responsibility for issue register keeping is no longer centralised within a single entity but “distributed” across the crypto-currency holder community (validation of operations through a consensus between these holders). That is why this new way of distributing asset custody responsibility ultimately appears to be more of a complement than an alternative to “Bearer” and “Registered” methods, as it targets assets with no issuer that are not covered by these existing methods.

From custody account keeping to position keeping

It would therefore not appear possible for a service provider to assume responsibility for standard custody account keeping for cryptocurrencies on behalf of a third party, as they do not have control of the custody system for these cryptocurrencies. However, they can continue to ensure Position Keeping on these assets, i.e. check that the quantity of cryptocurrencies recognised at Blockchain level complies with the transactions of which they are aware. This position keeping is not a new concept, as it was already proposed in the case of the associated Administered Registered Securities set-up mentioned above. There is, however, a substantial difference between the position keeping of cryptocurrencies and the position keeping of traditional assets (i.e. with an issuer). Indeed in the second case, it is possible for the position keeper to contact the issuer when he feels that the position is non compliant and the discrepancy is not attributable to him. Indeed, for Registered securities the issuer is supposed to have the power to rectify any anomaly concerning their own registers. However, this will no longer be possible with cryptocurrencies, where there is no issuer to contact.

Moreover, ensuring Position Keeping for a third party in a Blockchain obviously requires the holding (and therefore custody) of the means to access the third party’s tokens in this Blockchain, access that can for example be materialised via cryptographic keys.

The case of utility or security tokens

Some Blockchains, however, want to manage assets other than just their original cryptocurrencies. This is notably the case of Utility Tokens or Security Tokens that, despite the difference in the nature of the rights attached (usage rights versus financial rights), have the existence of a genuine issuer in common.

The presence of these issuers in the Blockchain thus requires them to be granted certain prerogatives on their own registers in comparison with the simple investors’ community. The placing of responsibility on investors alone is thus no longer justified, and it is therefore necessary to reconcile Blockchain and Registered forms as laid out in article R211-2 of the French Monetary and Financial Code. For all that, this articulation between the Distributed form and Registered form is not immediate and should require IT developments (smart contracts?) and/or appropriate authorisations depending on whether we’re dealing with a public blockchain (open to all with only one participant profile) or a private blockchain (reserved for certain participants with the possibility of various profiles).

International standards

In conclusion, when it comes to tokens it would be more pertinent to talk about “Position Keeping” than “Custody Account Keeping” even though, as we have seen, the Position Keeping of tokens is based on the custody of the means of accessing these tokens. Furthermore, as this issue goes well beyond French borders and French legislation, it would no doubt be desirable for the adjustments required to take issuers into account in blockchains to be the subject of norms and standards – certainly on a European level, and why not on a global level.