BLOCKCHAIN: quale custodia e per quali token?

L'organizzazione della custodia per criptovalute o altre cripto-attività (chiamate anche token) deve considerare alcune peculiarità, ad esempio l'assenza di un emittente identificato per le cripto-attività o la mancanza di controllo sul processo di custodia

Dalla dematerializzazione dei titoli avvenuta nel 1984, in Francia è possibile accertare la proprietà degli strumenti finanziari attraverso una scrittura in un conto titoli conservato presso:

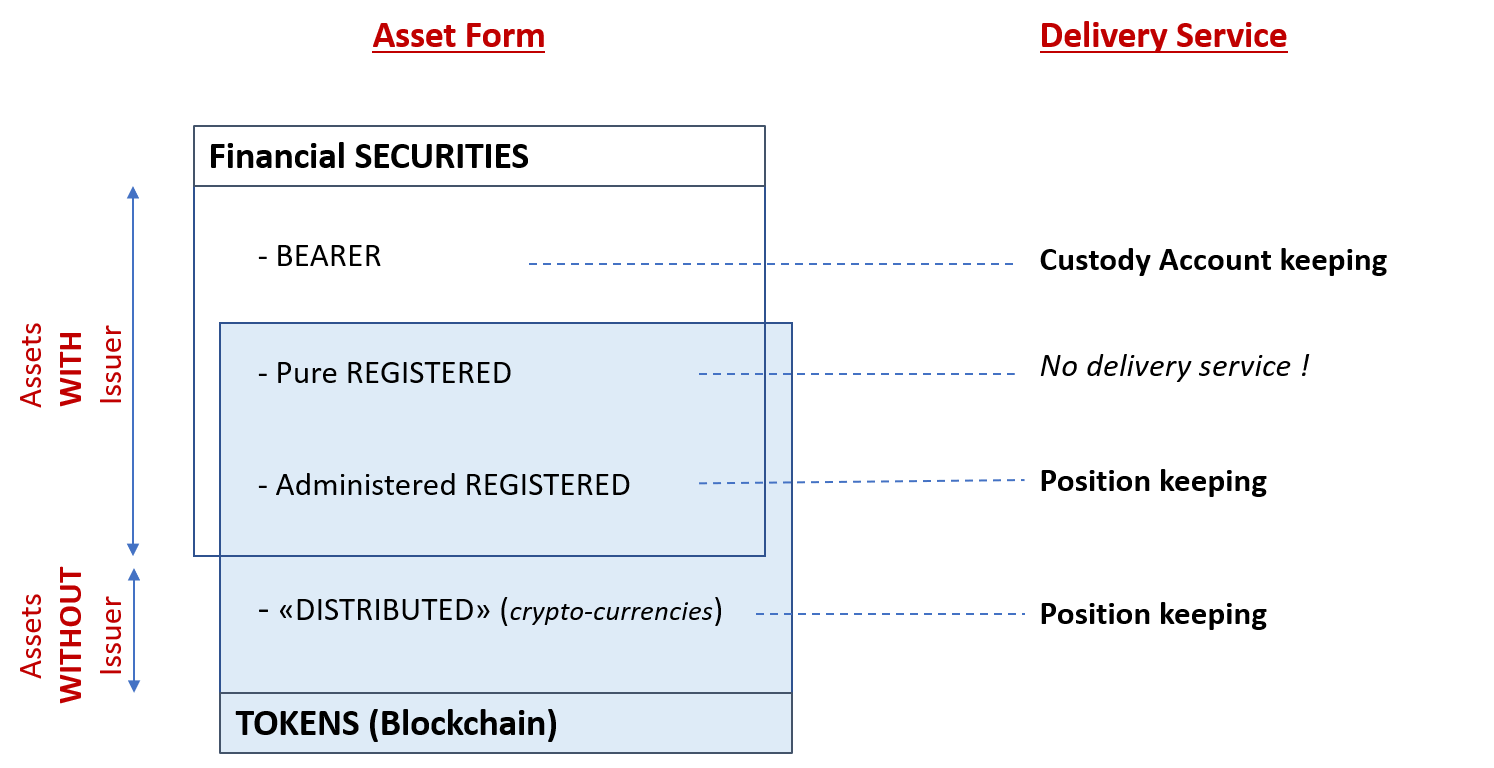

un intermediario finanziario autorizzato che opera in veste di “Depositario”; i titoli sono definiti al Portatore, in quanto l’identità dei rispettivi detentori non viene comunicata all’emittente al momento degli scambi su tali titoli, oppure;

l’emittente stesso; in tal caso, i titoli sono definiti Nominativi, in quanto l’emittente conosce l’identità dell’investitore. Qualora l’investitore incarichi un intermediario di conservare il suo conto titoli aperto presso l’emittente, si parlerà di strumenti “Nominativi Amministrati” mentre, in assenza di intermediazione, di strumenti “Nominativi Puri”.

Se da un lato la relazione con l’emittente risulta essenzialmente agevolata per i titoli nominativi, dall’altro le procedure volte al trasferimento della proprietà sono considerate più semplici e rapide per i titoli al portatore. In ogni caso, l’entità che custodisce il conto titoli ufficiale (emittente o intermediario) resta legalmente responsabile nei confronti dell’investitore finale e garantisce a quest’ultimo la facoltà di esercitare i diritti connessi alla proprietà del titolo per la sua intera durata. Alla luce del fatto che l’investitore può cambiare liberamente il depositario, quest’ultimo deve essere in grado di restituire, in qualsiasi momento, i titoli al rispettivo proprietario. Per fornire una simile garanzia, il depositario deve necessariamente saper utilizzare gli strumenti tecnici che assicurano tale custodia.

Il caso delle criptovalute

Poiché queste criptovalute non hanno un emittente, la responsabilità di tenere il registro delle emissioni non è più centralizzata su una singola entità ma "distribuita" sulla comunità dei possessori di criptovaluta.

La recente legge PACTE, adottata in Franca l’11 aprile 2019, ha fondamentalmente messo in discussione questo principio cercando di definire un servizio per la custodia degli “asset digitali” (altro nome per indicare i token) in cui il fornitore del servizio non è in genere in grado di gestire il dispositivo impiegato per trasferire la proprietà di tali asset. Il suddetto dispositivo è infatti basato sulla blockchain che, in principio, era stata appositamente concepita per garantire il trasferimento della proprietà e la custodia delle celebri criptovalute come Bitcoin o Ether. Dato che tali criptovalute non hanno un emittente in senso stretto, la responsabilità per la tenuta del registro di emissione non è più affidata in modo centralizzato a un’unica entità ma è “distribuita” tra i vari possessori di criptovalute (le operazioni sono convalidate tramite consenso tra tali soggetti). Proprio per tale motivo, questo nuovo metodo per distribuire la responsabilità associata alla custodia degli asset sembra infin dei conti più un elemento aggiuntivo che un’alternativa alle modalità “al Portatore” e “Nominativa”, in quanto si rivolge ad asset privi di emittente non contemplati da tali modalità ordinarie.

Pertanto, un fornitore non può assumersi a priori la responsabilità di una custodia tradizionale di criptovalute per conto di terzi, poiché non è in grado di gestire il dispositivo di conservazione associato a tali asset digitali. Può tuttavia continuare a offrire una Tenuta di Posizione per questi asset, ossia verificare che la quantità di criptovalute riconosciuta a livello della blockchain sia conforme alle operazioni di cui è venuto a conoscenza. Tale tenuta di posizione non è un concetto nuovo, in quanto era già proposta nell’ambito dei servizi associati ai titoli Nominativi Amministrati citati in precedenza. Le tenute di posizione relative alle criptovalute e quelle destinate agli asset tradizionali (ossia con un emittente) hanno però una portata differente. Nel secondo caso, infatti, il responsabile della tenuta può rivolgersi all’emittente qualora reputi la posizione non conforme o ritenga che non gli debbano essere attribuiti eventuali scarti. Per i titoli Nominativi, l’emittente ha presumibilmente il potere di correggere qualunque anomalia correlata ai suoi registri. Sfortunatamente, in assenza di emittenti tale pratica non sarà più applicabile alle criptovalute.

Inoltre, per custodire le posizioni per conto di terzi in una blockchain è ovviamente necessario detenere (e quindi conservare) i mezzi di accesso ai token dei terzi in tale blockchain, accesso che potrebbe ad esempio essere effettuato tramite chiavi crittografiche.

Il caso di utility o token di sicurezza

Alcune blockchain ambiscono tuttavia a gestire anche asset diversi dalle proprie criptovalute originali, nello specifico Utility Token o Security Token che, nonostante la diversa natura dei diritti connessi (diritti di utilizzo, da una parte, e diritti finanziari, dall’altra), condividono l’esistenza di un emittente reale.

Data la presenza di tali emittenti nella blockchain, è necessario riconoscere loro determinate prerogative sui propri registri che li distinguano dalla comunità di semplici investitori. Pertanto, la distribuzione della responsabilità tra i soli investitori non ha più ragione di esistere e sarà invece opportuno conciliare le blockchain e la modalità Nominativa, come oltretutto previsto dal Codice monetario e finanziario francese all’articolo R211-2. Tuttavia, la distinzione tra modalità Distribuita e Nominativa non è immediata e dovrebbe richiedere sviluppi informatici (smart contract?) e/o specifiche autorizzazioni in base al tipo di blockchain: pubblica (aperta a tutti con 1 solo profilo di partecipanti) o privata (riservata a determinati partecipanti con una possibile differenziazione dei profili).

Standard internazionali

In conclusione, nell’ambito dei token sarebbe più opportuno evitare il termine “Custodia” e parlare di “Tenuta di Posizione” anche se, come abbiamo visto, tale operazione si basa sulla capacità di conservare i mezzi di accesso ai token. Inoltre, dato che la questione supera ampiamente i confini della Francia e il suo quadro normativo, sarebbe indubbiamente auspicabile che gli accorgimenti necessari per tenere conto degli emittenti nelle blockchain siano almeno oggetto di norme a livello europeo e preferibilmente internazionale.