“Gates” mechanism: an SGSS solution to meet the challenge of liquidity risk

SGSS automates the Gates mechanism to meet the needs of asset managers.

The recommendations of the French Financial Markets Regulator (AMF) and the French Association of Securities Professionals (AFTI) on the prevention of liquidity risk

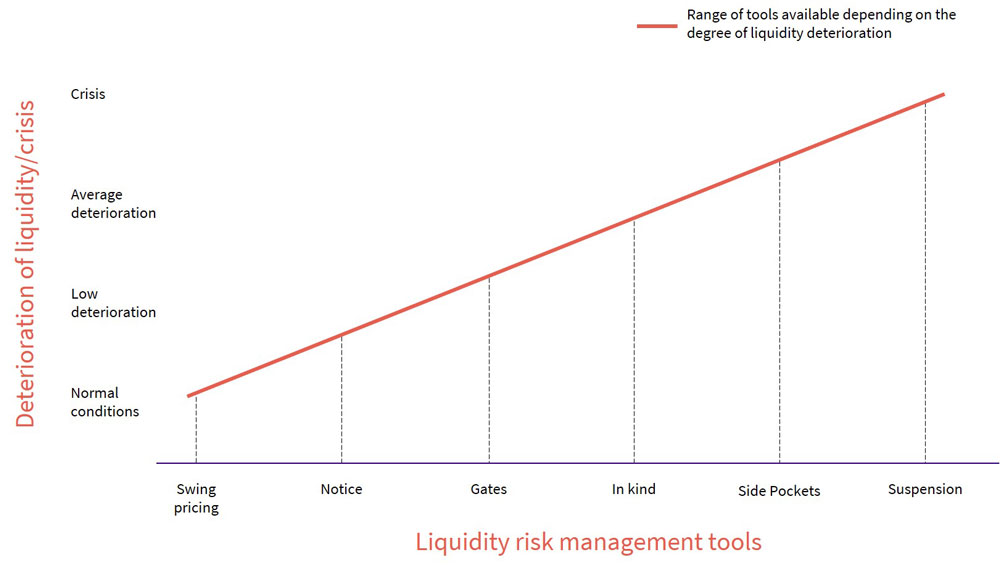

Managing liquidity risk is essential for asset managers: it ensures that investors have access to the stated liquidity in compliance with the fundamental principles of equal treatment of unitholders and market integrity. In order to limit this risk, in 2008 the AMF authorised the implementation of “Gates” on alternative investment funds (AIFs), a measure which was extended to UCITS in 2017 (see AMF instruction 2017-05 of 15/03/2017), as in other European countries. This mechanism for managing liquidity risk comes in addition to other existing methods: swing pricing, notice, redemption in kind, side pocket, suspension, etc.

A significant requirement in terms of preventing market risk in the face of recent fund liquidity difficulties (e.g. Woodford and H2O crises)

Different mechanisms can be used by the asset manager as long as they are specified in the prospectus.

SGSS has a range of tools used to manage liquidity risk:

Swing pricing and adjustable entry/exit fees on the fund: These are the first bastions of defence against a limited drop in liquidity; their objective is to reduce the cost of reorganisation of the portfolio linked to subscriptions/redemptions.

Swing pricing: Investors bear the costs linked to transactions processed on the assets by adjusting the net asset value. In the case of adjustable entry/exit fees on the funds, only joining/leaving investors bear these costs.

Notice: Incentive or imperative notice periods allow the asset manager a time lapse (which is set in the prospectus) between the date of the order and its execution. This enables managers, for some positions that are less easily liquidated, to structure their sales on the market in order to conclude them under the best possible conditions.

Gates: These allow managers to stagger redemptions on multiple net asset values via a temporary ceiling, in order to meet two objectives:

maintain the quality of the assets in the funds by protecting them from forced sales under unfavourable conditions;

enable the fund to honour redemptions progressively while maintaining equal treatment of unitholders.

Redemption in kind: The principle is to transfer portfolio investments to investors in proportion to their holdings in the fund, provided the investors have given their consent to this.

Side pocket: A mechanism for responding to an exceptional but limited crisis, only affecting certain assets in the fund, representing a low proportion of total assets. This preserves the open nature of the fund, without having to resort to forced sales that may be against unitholders' best interests. The mechanism creates two new funds by splitting the initial fund.

Suspension (soft/hard closing): Total or partial closure of subscriptions and/or redemptions under exceptional market conditions.

The Gates solution is already 100% operational at SGSS:

SGSS, a member of AFTI's "Flux et Stock" working group, contributed to the market project jointly established by AFTI and AFG, which gave rise to the preparation of a charter relating to the implementation of Gates on UCITS funds in France. The project has a dual objective:

To respond to the launch of Gates by asset managers on an open UCITS fund with a high transaction volume;

To enable the market participants involved in the subscriptions/redemptions chain to respond to the widespread automated application of Gates.

Details of the work are available on the France Post-Marché website.

SGSS thus offers an innovative response by proposing an automated solution to process Gates on AIFs as well as UCITS funds. This solution, the first of its kind in France, allows the application of Gates on high volumes of inflows to be processed securely.

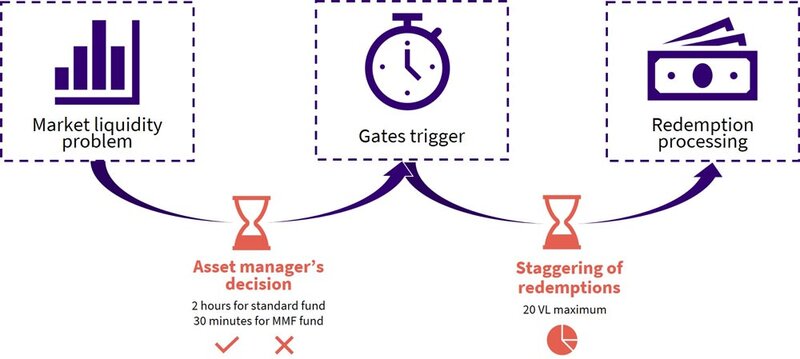

The Gates solution: how it works and how it is implemented at SGSS

As well as market recommendations defining a standard Gate management service, SGSS offers a customised and flexible service to its clients. SGSS provides asset managers with a mechanism to monitor their inflows/outflows, so that they can see as soon as possible when the Gates threshold has been reached. In addition, when a Gate is applied, SGSS sends a summary statement of pro-rated orders for control and validation before processing in the order book. This is in addition to the notification sent to the account holding teams for investors/distributors, as soon as the asset manager's decision to activate the Gate is known, and the notification of the result on the orders collected.

SGSS offers:

An automated system

Gates services

Prospectus configurations

Gates application

Processing of pro-rated orders

Deferral or cancellation of residual orders

Exchange of information

Between the asset manager and SGSS

Validation of Gates to be applied

Notifications to the account-holding teams of affected investors/distributors, the asset manager and the custodian control

Additional reporting (optional)

Monitoring of inflows and ratio of outflows

Alerts on close to notify asset managers as soon as they have exceeded an outflow threshold

Our experts are available as of now to implement this SGSS Gates mechanism on your French funds.

Morgane Seveno (Product manager fund distribution France & Trustee)