The Next AI Breakthrough Will Be Built With Steel and Concrete

Throughout history, transformative technologies—from the steam engine to electricity and the internet—have reshaped economies and redefined productivity limits.

Today, artificial intelligence (AI) stands as the next great inflection point. Enabled by exponential advances in compute power, AI is driving a new wave of innovation that could rival or even exceed previous industrial revolutions.

In recent years, public imagination has been captivated by generative AI, particularly chatbots and large language models (LLMs). But the next frontier is rapidly emerging. Agentic AI systems that can autonomously plan and act, and physical AI in the form of robotics, are poised to unlock the next phase of productivity growth. These technologies will not just process information; they will operate in the physical world, revolutionising sectors from healthcare to logistics, manufacturing and beyond.

This transformation will require a sweeping buildout of physical AI infrastructure. Brookfield estimates that more than $7 trillion in capital investment will be required globally over the next 10 years to meet rising AI demands. This includes AI factories, power & transmission, compute infrastructure and adjacent sectors like fibre networks and chip manufacturing.

The Age of Abundance and the Jevons Paradox

The promise of AI is more than just automation. It’s about dramatically reducing the marginal cost of producing essential resources and services to make them widely accessible and affordable, potentially ushering in an Age of Abundance. AI-led automation could lead to massive growth in global gross domestic product (GDP), potentially reaching $10 trillion in annual economic productivity gains in the next decade.1

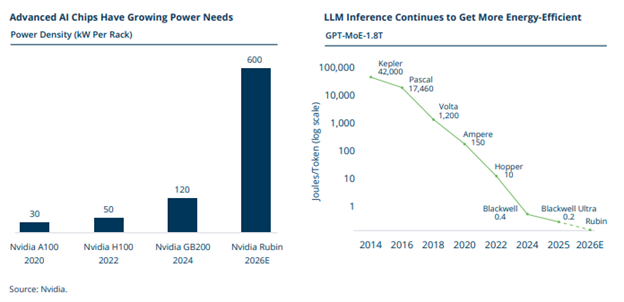

However, increased efficiency won’t dampen demand—it will accelerate it. This is the Jevons Paradox in action. Just as energy consumption rose despite falling electricity costs over the past 70 years, AI compute demand is expected to surge as unit costs drop. Since the release of ChatGPT in late 2022, the marginal cost of running AI models fell 99%, driven by algorithm and hardware improvements.2 Meanwhile, hyperscaler capital expenditures on GPUs, data centres and networking continue to climb,3 confirming long-term confidence in AI’s trajectory.

Why Infrastructure Matters More Than Ever

Unlike previous technological waves that relied on relatively lightweight software deployments, AI demands a robust and capital-intensive physical footprint.

Modern AI models require massive computational horsepower, supplied by dense clusters of GPUs and supported by advanced liquid cooling systems. AI hubs are evolving into “AI factories”—next-generation digital campuses optimised for high-performance computing that require much more power than traditional cloud servers use.

Power is emerging as a critical bottleneck. In some regions, it can take up to 10 years to secure grid interconnection, far longer than it takes to construct the facilities themselves. To address this, Brookfield and other developers are increasingly turning to behind-the-meter solutions—including onsite generation, battery storage and even advanced nuclear options such as small modular reactors (SMRs). These modular power systems allow facilities to scale independently of local grids and provide a resilient energy backbone to support AI’s rapid growth.

Sovereign Demand and the Rise of AI Gigafactories

Governments around the world are now treating AI infrastructure as a strategic asset. National security, economic competitiveness and data sovereignty are driving countries to sponsor AI gigafactories, re-shore semiconductor supply chains and streamline regulatory processes.

In Europe, Brookfield has entered into a €20 billion strategic partnership with the French government to build AI infrastructure, including a flagship 1 GW AI campus, as well as a $10 billion partnership with the Swedish government to develop a national AI centre.

More than symbolic, these public-private partnerships are shaping the next generation of industrial policy. Much like the previous buildout of railways and power grids, today’s sovereign AI strategies require policy alignment along with operational expertise and capital discipline.

Investable Business Models Emerge

This historic buildout is giving rise to several high-conviction investment opportunities across the AI infrastructure value chain:

AI Factories and Data Centres: Demand for purpose-built hyperscale campuses is soaring and commanding a premium relative to traditional infrastructure.

GPU-as-a-Service: Rather than owning costly AI hardware, enterprises are opting to lease compute capacity. We expect this market to grow from $30 billion in 2025 to over $250 billion by 2034, supported by long-term take-or-pay contracts with creditworthy clients.

Power Solutions: Along with speed-to-market advantages, onsite generation and energy storage systems offer investment characteristics such as long-term cash flows, downside protection and strong credit profiles.

Strategic Adjacencies: Investments in supporting sectors—such as fibre networks, semiconductor fabs and robotics manufacturing—offer additional layers of durable, long-duration returns aligned with national policy priorities.

AI infrastructure also must be adaptable. With GPU lifecycles shortening to 12–18 months, and new AI architectures requiring ever-higher power densities and advanced cooling, obsolescence is a real risk. Developers can mitigate these risks through modular designs and partnerships with hardware vendors to ensure rapid tech refresh cycles and upgrade flexibility.

Looking ahead, inference—not training—will drive the majority of compute demand. By 2030, we see inference driving 75% of AI workloads as models become embedded into real-time applications across every industry.

Meanwhile, robotics will place new demands on physical infrastructure. Humanoid robots, powered by multimodal AI models, are expected to reach production volumes in the millions within a decade, creating another layer of capital formation across industrial AI ecosystems.

The Defining Opportunity of Our Time

The emergence of AI is not just a software revolution—it’s a physical one. The infrastructure required to enable it is vast, complex and mission-critical, and the $7 trillion in capital needed—whether in the form of debt or equity—is just one of key requirements. Those with access to the right capital, partnerships and policy alignment, the expertise to build and operate at scale, will shape the future.

Hadley Peer Marshall, Chief Financial Officer, Brookfield Asset Management; Managing Partner, Infrastructure

1IDC, "The Business Opportunity of AI," November 2023.

2OpenAI, “GPT-4o mini: advancing cost-efficient intelligence,” 18 July, 2024.

3Source: Microsoft, Meta, Amateron, Alphabet and Oracle SEC filings and earnings releases, 2025.