Is ESG dead ?

Anti ESG rhetoric and headlines from the US have been dominant in both mainstream and sustainability focused media in recent months. But the challenges started more than two years ago. After strong momentum in the years following the Paris Agreement in late-2015, fuelled further by extensive regulatory developments such as the launch of SFDR in Europe, governments’ collective ambition and action toward decarbonisation has waned, as has the aggregate ambition of companies.

The ESG backlash and backtrack has really started around 2022 and is currently amplified by political divide. While even over the last decade, sustainable investment has been through phases of different areas of focus, what we have seen over the last few months have heralded a change in tone which we believe will lead to a new phase in the industry’s evolution.

Transition versus physical risks

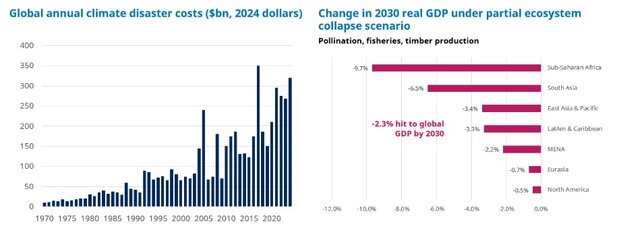

Clearly, transition risks are not expected to increase further in the current geopolitical context. However, this does not make sustainability factors any less important. Climate change, nature loss, social inequality and unrest, workplace changes and many other social and environmental trends continue to intensify and are in many cases already impacting businesses. The global annual financial cost of climate disasters has significantly increased in recent years, being more than 50% higher in the last decade compared to the previous 10 years1. At the same time, the potential impacts of nature loss on global GDP and on financial stability is an important area of focus for central banks, with the Network for Greening the Financial System supporting the development of scenarios for assessing nature-related economic and financial risks. The World Economic Forum Global Risks reports have placed environmental risks at the top of businesses considerations on a 10Y horizon. In 2025, extreme weather events and pollution were flagged as the second and sixth key risks on a 2 years horizon2.

Source: LHS: Munich Re, Swiss Re. RHS: World Bank.

Implications for investors

For centuries, the global economy has grown, while in parallel environmental and social pressures have intensified. Those pressures have become unsustainable. Hence, unwinding and reversing them is a necessary while extremely difficult task.

The sustainability – and notably climate - objectives some asset owners and managers have established were predicated on a continuation of the strengthening ambition of the years prior to 2022. They look more challenging against a backdrop of stalling momentum.

Our ability to examine those trends – leveraging the fundamental insights of analysts and fund managers rather than reliance on data mining and statistics alone – is a key part of the value we can bring to our clients. But it does emphasise the importance of, firstly, focusing on the implications of social or environmental changes on economies, industries, companies and investments. And, secondly, of applying hard-nosed criteria to determine which issues are material – and how – to the portfolios we manage, given their objectives.

We believe that transitioning portfolios proactively to mitigate the risks a climate and nature transition poses remains important, but doing so requires investment in transitioning assets rather than applying top down constraints on portfolio decisions. This is undoubtedly harder, but necessary to ensure sustainability and climate priorities enhance rather than limit investment performance. The same picture holds across many areas of sustainable investment. We recognise that crude portfolio constraints, restrictions or allocation decisions are unlikely to yield the investment outcomes our clients expect, or that are possible against a backdrop of economic and market disruption in which social and environmental trends are an unavoidable component.

In a transition that we feel all countries and markets will ultimately need to tackle, unprecedented sums of capital may need to move from damaging areas of economies to more sustainable activities. As a result, forward-thinking companies could be positioned to help their clients grow their wealth by focusing on navigating the risks and opportunities these social and environmental challenges create for investors’ portfolios. This is why we believe in the durability of these themes and consider that the long-term driving forces that are observable now will continue to have a global impact for years to come.

Nathaële Rebondy, Head of Sustainability Europe, Schroders

1Source: LHS: Munich Re, Swiss Re. RHS: World Bank.

2Source: LHS: Munich Re, Swiss Re. RHS: World Bank.