Transition to the T+1 settlement cycle in Europe

The transition to the T+1 settlement cycle in Europe marks a major milestone for the financial markets. Following the adoption of T+1 in the US and Canada in 2024, the European Union is preparing to meet this challenge in October 2027. This transition, which reduces the settlement time, requires an overhaul of post-trade processes, increased automation and increased coordination between all market participants. What are the challenges, impacts and recommendations for making this strategic change a success?

Learn more about Post Trade - US T+1: settlement cycle shortened to T+1 in the US market

Why is the transition to T+1 in Europe such a major challenge?

The shortening of the settlement cycle is a natural evolution of the financial markets, driven by automation, streamlining and harmonisation. After the transition from T+5 to T+3 in France in the 90s, then to T+2 in Europe in 2014, Europe is now preparing to adopt T+1 in October 2027.

Scaling up

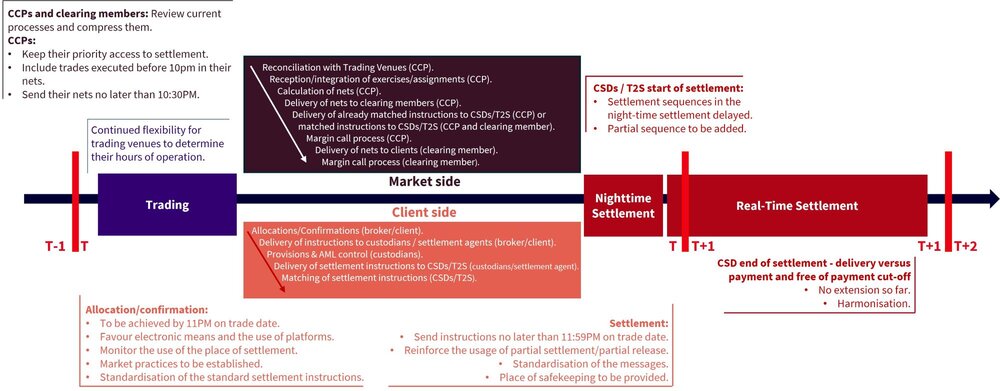

Until now, the compression induced by this movement was calculated in days, but now it will be measured in hours.

All steps must be completed in just a few hours, from the execution of a transaction to its handling by a CSD (Central Securities Depository).

For the CSDs that offer it, the night cycle remains essential for optimising the “settlement day”: of course, a transaction will have up to T+1 +/-16h to settle, so it might be tempting to think these constraints are “unnecessary” and wonder what is the point of forcing ourselves to fit everything into a few hours. But this kind of thinking would overlook the main role played by the night cycle, which begins at the end of the day at T in the overall process. In its most finalised version, this is the moment when optimisation is strongest in the “settlement day”. The industry has understood this and, in fact, is operating on the principle that the current system’s functioning should not be compromised.

European governance to steer the transition

To complete this transition to T+1, European governance was put in place in early 2025, under the responsibility of the Industry Committee, bringing together industry, legislators and regulators. Its report published on 30 June 2025:

Proposes a set of recommendations to enable a successful transition to T+1 in October 2027.

Is the result of 5 months of intensive work carried out by 10 groups covering all facets of trade and post-trade and affecting all industry players (buy-side, sell-side, custodians, market infrastructures, etc.). An 11th group (Operational Timetable Coordination Group) was tasked with redesigning the “settlement day” and making it possible to do what currently can be done in 27 hours in just 3 hours.

Suggests an “Adhere or Explain” approach.

Is important because it lays down the changes to be carried out and helps industry players to better understand the impacts on their activities.

Impacts on the financial ecosystem

It is becoming clear that the transition to T+1 requires multiple implementations on the part of all market players, who must collectively prepare.

Firstly, the processing of transactions directly concerned (those involving securities and executed on a trading platform) requires greater automation of processes – thus making it possible to move towards “real time” – and higher quality of data (in particular during the allocation/confirmation phase), as well as the immediate monitoring of any malfunctions. This is because settlement instructions must be sent on time and in their final version (corrections made after the fact must only happen in exceptional circumstances and be made as quickly as possible). The introduction of standards or new market practices should facilitate the necessary changes.

But beyond that, the entire ecosystem is impacted by this change.

This includes effects on:

The primary fund market

The securities financing market

Foreign exchange transactions

Each stakeholder must analyse and implement the necessary changes in 2026 to stay on course for October 2027.

The challenges and opportunities of the transition to T+1 in Europe

Key issues:

Optimisation of operational processes.

Strengthening of IT infrastructure.

Risk management and coordination between all market participants.

Opportunities:

Efficiency gains through automation and digitalisation.

Harmonisation of practices for activities outside the scope of “mandatory T+1”: of course, the rule remains a bilateral agreement on the settlement date, but some of these activities will benefit from following the same cycle in Europe.

In summary, the transition to T+1 is not without its challenges. Speed, quality, monitoring and commitment from everyone are the watchwords for a successful transition.